b&o tax rate

The New Jersey sales tax rate is currently. The Township tax rate had no increase in 2021 2020 and 2019 after having been lowered in 2018 by 128 percent.

If any taxpayer fails to remit the BO return or fails to remit in whole or in part the proper amount of tax a penalty in the amount of five percent 5 of the tax for the first month or fraction thereof of delinquency and one percent 1 of the tax for each succeeding month or fraction thereof of delinquency.

. The Piscataway sales tax rate is. What is the sales tax rate in Piscataway New Jersey. This is the total of state county and city sales tax rates.

The County sales tax rate is. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates ranging from 0138 percent to 15 percent. This number matches the four times that Money Magazine placed Piscataway Township.

Auburn 253 876-1923 0001 0001 00015 00018 500000. Seattle is currently the only city with a. This evening for four years in a row Mayor Brian C.

Please understand though that other governing authorities such as Middlesex County and the school board determine their own tax rates and budgets. Piscataway Township hits a four-year stride with a 128 percent lower municipal tax rate. Algona 253 833-2897 000045 000045 000045 000045 10000 40000.

What are the penalties for unpaid BO Tax. The Retailing BO tax rate is 0471 percent 00471 of your gross receipts. The current gross receipts tax rate of 01496 percent applies to all gross receipts tax classifications.

100000 the business pays 222. Answer Simple Questions About Your Life And We Do The Rest. The minimum combined 2022 sales tax rate for Piscataway New Jersey is.

The Piscataway New Jersey sales tax rate of 6625 applies to the following two zip codes. Wahler and the Township Council presented an annual budget with a lower municipal tax rate. Local business occupation BO tax rates.

It is measured on the value of products gross proceeds of sales or gross income of the business. Did South Dakota v. There are approximately 43900 people living in the Piscataway area.

Business and Occupation Tax. For retail businesses where the BO tax is based on gross receiptsincome the maximum tax rate may not exceed 02 of gross receipts or gross income unless approved by a simple majority of voters RCW 3521711. How the tax works.

Your gross revenue determines the amount of tax you pay. Both Washington and Tacomas BO tax are calculated on the gross income from activities. An alternative sales tax rate of 6625 applies in the tax region Middlesex Borough Ny which appertains to zip code 08854.

For example if the retail sales tax rate is 000222 222 and the business has a taxable gross revenue amount of. For fourth year in a row Piscataway Township has a 128 percent lower municipal tax rate. Aberdeen 360 533-4100 0002 0003 e 00037 e 0003 e 5000 20000.

The gross receipts BO tax is primarily measured on gross proceeds of sales or gross income for the reporting period. In addition retail sales tax must also be collected on all sales subject to the retailing classification of the BO tax unless a specific retail sales tax deduction or exemption applies. The City Business Occupation BO tax is a gross receipts tax.

Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline telephone and telegraph companies water carriers by steamboat or steamship and motor carriers. To calculate this amount multiply your taxable gross revenue amount by the tax rate.

Washington unlike many other states does not have an income tax. April 20 2021 Four is the new big number in Piscataway.

B O Tax For Auburn Businesses Here S What You Need To Know Auburn Examiner

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

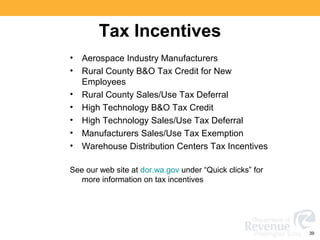

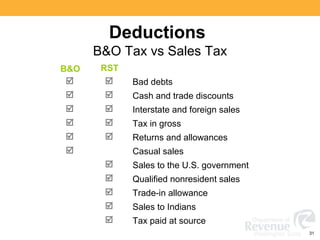

Washington State Sales Use And B O Tax Workshop

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us